This Week in Tanzanian Tech [May 25-31, 2025]

Here’s what caught our attention lately:

Tech event organizers targeting 300+ physical delegates and 500,000 online viewers

Artificial intelligence enabling groups as small as five people to access life insurance

Forty African countries meeting in Dar to solve continental internet challenges

We also highlight 7 other important headlines.

Training Spotlight

This newsletter comes to you with support from Cybergen, Tanzania’s leading tech education provider.

The company runs its Monitoring, Evaluation & Learning (MEL) workshop from June 16-20 in Dar es Salaam, targeting professionals who use data for impact measurement.

Registration closes June 10 with certification provided upon completion. Register here.

1. Zanzibar Tech Summit Returns with Three-Day Format and Investment Focus

Setting the stage.

Zanzibar’s second annual tech gathering has expanded from a single-day event to a comprehensive three-day experience.

The organizers behind (Lepole Dides and Zanziholics Digital Agency) have officially launched the Zanzibar Tech & Investment Summit 2025, scheduled for July 3-5 with an anticipated 300+ delegates attending physically and 500,000+ viewers participating online.

That is a big change from the inaugural 2024 event held at The Pavilion in Fumba Town.

The expansion.

This year’s summit operates across three distinct venues with specialized programming for different audiences.

It features fireside chats at Aura Space, followed by the main conference day at The Pavilion, and concluding with a 6-hour yacht cruise for premium ticket holders.

The event targets entrepreneurs, tech developers, venture investors, and policymakers with sessions covering artificial intelligence, emerging technologies, and sustainable investment strategies.

Early bird pricing starts at Sh30,000 for regular access, Sh120,000 for full delegate passes, and Sh260,000 for VIP experiences. You can book your ticket here.

“This Summit creates a vital platform to promote collaboration between the public and private sectors,” said Lead Organizer Chukwudozie Onwughalu, during a recent press conference.

Fact.

Since Tanzania’s startup ecosystem grew 77% from 2021 to 2024, Dar es Salaam’s dominance has decreased.

This creates opportunities for Zanzibar to capture emerging tech companies seeking alternative locations with government incentives like 10-year tax exemptions.

What’s ahead?

Early bird registration closes June 16, with tickets available through Nilipe, Otapp, Senjaro, and Lu.ma platforms.

The summit builds on the government-led Silicon Zanzibar initiative, which has already attracted IIT Madras’s first international campus and Princeton University partnerships.

Programming will include startup pitch competitions, AI masterclasses, and investment panels designed to connect African tech leaders with funding opportunities while positioning Zanzibar as a regional innovation hub beyond tourism.

You can secure your ticket here.

2. NMB Bank Launches WhatsApp-Based Group Insurance with AI Integration

First, some context.

NMB operates Tanzania’s largest banking network with 241 branches and Sh14.3 trillion ($5.3Bn) in total assets as of March 2025.

The bank has partnered with Metro Life Assurance to launch the country’s first WhatsApp-enabled group life insurance service.

This allows community groups (vikundi) to purchase and manage coverage entirely through their favorite messaging platform.

The digital solution eliminates paperwork and branch visits while targeting the 13.8 million Tanzanians currently covered as insurance beneficiaries but lacking direct policy ownership.

The technology?

This new service integrates generative AI through NMB and iPF Softwares’ chatbot called JIRANI. This assistant is accessible via WhatsApp number +255 747 333 444.

Group members contribute Sh500 monthly each, ensuring that when any member dies, their beneficiaries receive up to Sh5 million ($1860).

The system uses optical character recognition (OCR) for document processing, natural language processing (NLP) in Swahili and English, and automated claims management that processes payments within 48 hours.

Groups as small as five people can enroll without formal registration requirements.

“By leveraging popular digital platforms like WhatsApp, we are removing traditional barriers and extending coverage to people in even the most remote and informal communities,” said Filbert Mponzi, NMB’s Chief of Retail Banking.

Fact.

With over 40 million adults either uninsured or relying on indirect coverage, the nation’s insurance market remains largely untapped.

What’s ahead?

The partnership builds on NMB's existing “Mkono wa Pole” group insurance product first introduced in 2022, now improved with digital automation.

TIRA Commissioner Dr. Baghayo Saqware endorsed the initiative as advancing financial inclusion objectives while Metro Life CEO Amani Boma indicated plans for additional WhatsApp-based insurance innovations.

The service launches immediately through NMB’s agent network, targeting VICOBA (village community bank) groups, workplace teams, and community organizations seeking affordable collective coverage.

3. Africa’s Internet Leaders Gather in Dar

Behind the walls.

At the Julius Nyerere International Convention Centre (JNICC) last week (May 29-31), delegates from 40 African countries spent three days debating a strange contradiction.

While Africa leads global mobile money transactions with $1.1 trillion annually—representing 74% of worldwide volume—only 38% of the continent’s population can access the internet, compared to a 68% global average.

The 14th Africa Internet Governance Forum (AfIGF) brought together ministers, parliamentarians, and tech leaders to address this digital paradox.

The agenda.

Over 300 participants engaged in 47 sessions covering artificial intelligence governance, cybersecurity frameworks, and cross-border digital cooperation.

Tanzania’s government used the platform to launch its AI Readiness Assessment Report, developed with UNESCO support and involving 240 stakeholders across government, academia, and private sector.

The document positions Tanzania among 23 African countries receiving AI readiness evaluations that provide strategic recommendations for responsible AI adoption.

Sessions ranged from technical workshops on internet infrastructure resilience to policy debates about leveraging the African Continental Free Trade Area’s (AfCTA) digital trade protocols.

“Africa must speak with clarity, Africa must speak with unity, and Africa must speak with purpose,” emphasized one keynote speaker addressing the Global Digital Compact negotiations.

Reality check.

Despite having 82% mobile network coverage across Africa, 70% of people living within coverage areas remain unconnected to the internet.

In other words, affordability and device access barriers are the primary obstacles to digital inclusion. Infrastructure limitations are not the main issue!

Moving forward.

The forum established an African Parliamentary Network for Science, Technology and Innovation. Its members include representatives from each African region. They aim to harmonize digital governance laws across the continent.

Tanzania, on the other hand, committed to expanding its fiber optic connectivity to DR Congo via Lake Tanganyika while offering digital government systems to other African nations.

Select AfIGF 2025 delegates will present African perspectives at the Global IGF in Norway later this year. Hence, carrying forward discussions about data sovereignty, AI ethics, and closing connectivity gaps that keep millions offline despite expanding infrastructure.

ADDITIONAL HEADLINES

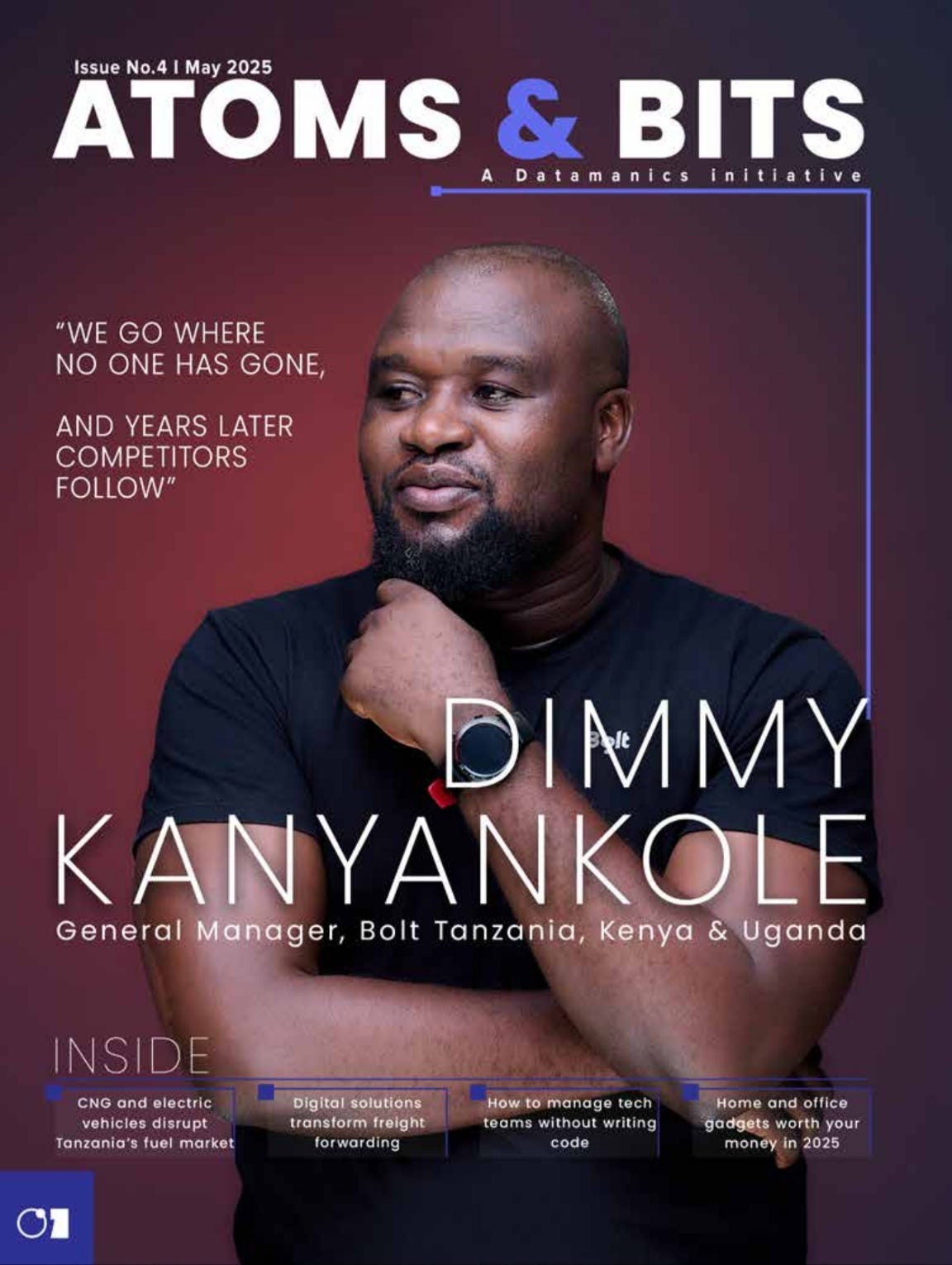

Atoms & Bits Magazine Issue #4 Now Available

We have just published our May 2025 edition featuring Bolt GM Dimmy Kanyankole on ride-hailing expansion across East Africa.

The 52-page issue examines CNG adoption economics, aviation’s $3.8 billion GDP contribution, Zanzibar’s coding education targets, plus so much more.

Read it here.

Otapp Launches Single App for Multiple Services

The e-ticketing startup released an updated mobile application on May 30 that includes bus, flight, event, and cargo booking capabilities.

This replaces the company’s previous approach of operating separate apps for different booking categories.

Otapp handles 1400+ daily bus bookings and maintains approximately 40% market share in Tanzania’s upcountry bus industry.

Tanzania Revives Local ARV Drug Production Through TPI Arusha

Health Minister Jenista Mhagama has announced plans to restart antiretroviral drug manufacturing at Tanzania Pharmaceutical Industries in Arusha as part of a Sh1.61 trillion healthcare budget.

The government allocated Sh93.16 billion for ARV procurement between March and June 2025 while addressing reduced international funding.

Tanzania imports over 85% of its pharmaceutical needs, spending approximately $1 billion annually on foreign drugs, according to TIC.

Dawa Mkononi CEO Joins Africa Supply Chain Conference Panel

The pharmaceutical procurement platform’s founder will represent Tanzania at the 47th SAPICS Annual Conference (June 8-11) in Cape Town as a panelist.

Their digital marketplace serves over 1,000 pharmacies and clinics while providing over $4 million in credit financing to healthcare providers that serve 500,000+ patients across Tanzania.

SarataniAI Advances in VDA 2025

The cervical cancer diagnostics startup has reached the top 10 finalists in Vodacom’s current accelerator cohort.

This gives it access to advanced mentorship and rapid prototyping training.

The company recently secured partnerships with Muhimbili National Hospital and Ocean Road Cancer Institute for local data collection.

M-Taka Launches Smart Waste Management Platform

The mobile-first solution enables households and businesses in Dar to schedule waste pickups, track collection trucks in real-time, and pay via mobile money.

Founded by Josiah Essau through his Yala Cleaners experience, M-Taka addresses missed pickups and poor coordination in Tanzania’s waste collection system.

The platform provides digital receipts and targets residents, waste operators, municipal partners, and civic organizations.

Tanzania Processes 1.5 Million Digital Transactions Daily

Banks and mobile money providers handle Sh29.9 trillion ($11.2Bn) annually through a unified payment system connecting 45 financial institutions.

The country built this infrastructure using local developers, eliminating previous complex agreements between different providers.

Current usage represents only one-third of the system’s total capacity, according to Bank of Tanzania and FSDT research.