This Week in Tanzanian Tech [Mar 2-8]

Beem attends Barcelona event, Qatar Charity partners with Sarafu, Kleenair converts 60 vehicles to natural gas, plus 7 more ecosystem updates

1. Connectivity Infrastructure Provider Strengthens Key Alliances

Green Telecom is cementing partnerships with major industry players as Tanzania’s telecom sector heads toward a projected $6.85 billion valuation by 2030.

Last week, the firm hosted executives from Vodacom at its headquarters to “discuss ongoing partnership and explore new synergies,” according to a company statement.

That meeting follows Green Telecom’s recent announcement as an authorized reseller for Cambium Networks to expand its wireless connectivity offerings.

Founded in 2013, Green provides telecom infrastructure services, including integration of radio base stations, microwave transmission, and fiber optic installations.

The company has been building relationships across Tanzania’s business scene, with recent meetings involving Hebei EagleFly (a Chinese SIM card provider) and the Capital Market and Securities Authority (CMSA).

Tanzania’s telecom market, currently generating an estimated $2.2 billion in annual revenue, is growing at 6.1% yearly.

This growth comes as the country pushes to close its digital divide through the Digital Tanzania Programme, which has already helped increase 3G coverage from 67% to 74% year-on-year in September 2024.

The government’s July 2024 commitment to connecting 8.5 million previously unserved people includes building 758 new towers and upgrading 304 existing ones.

This infrastructure expansion, funded through public-private partnerships (PPPs), represents a major opportunity for companies like Green Telecom that specialize in telecom installations and managed services.

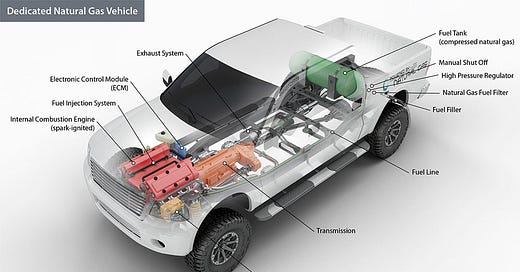

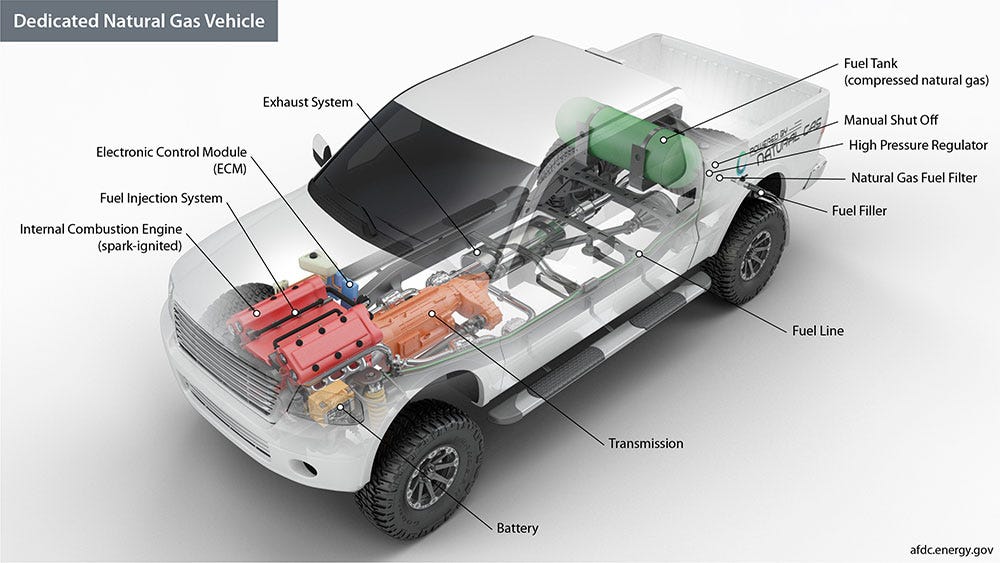

2. Kleenair Delivers on TPDC Vehicle Conversion Contract

Kleenair CNG Limited has converted 60 out of 78 government staff vehicles to run on compressed natural gas under a contract with Tanzania Petroleum Development Corporation (TPDC), Director Adnan Mohammed revealed on March 4.

Founded in 2022, Kleenair specializes in converting conventional vehicles to run on domestically produced natural gas. It operates in an expanding market since Tanzania seeks to utilize its 57.54 trillion cubic feet of gas reserves.

For drivers considering the switch, the economics make sense. Compressed natural gas provides better mileage than petrol—around 13.9 km per kg compared to 10 km per liter of petrol—while costing half as much at TZS 1,550/kg versus TZS 3,200/liter for petrol.

“This translates to fuel cost savings between 50-75% for petrol vehicles,” according to Mohammed, while “vehicles running on diesel see more modest savings of 15-20% since they use CNG alongside the original fuel.”

For trucks, Kleenair offers additional options.

“We are converting trucks to Monofuel CNG, which would result in 55% savings," Adnan tells Atoms & Bits. The “Dual Fuel option conversion offers 17-25% savings since it uses both fuels at the same time.”

Converting a standard four-cylinder petrol car currently costs TZS 2,390,000, with financing available through Selcom Microfinance Bank.

The financing requires a “TZS 50,000-70,000 advance payment and daily payments as low as TZS 7000,” making the conversion more accessible to drivers.

Infrastructure continues to constrain market growth. Tanzania currently has four operational CNG stations as of January 2025, with “8-10 new stations expected by the end of 2025,” according to Kleenair.

The current refueling network includes “1 mother station at the University of Dar es Salaam (UDSM) and 6 mobile refueling stations (2 in Dar, 2 in Morogoro, and 2 in Dodoma).”

Recent policy changes have improved the business case for CNG. The 2023 amendment to the Value Added Tax Act removed VAT on conversion components and exempted import duties on CNG cylinders for vehicles, reducing costs and encouraging wider adoption.

As a result, the expanding CNG sector presents opportunities in vehicle conversion services, fueling infrastructure, component manufacturing, and conversion financing. TPDC is actively seeking joint venture partners for development projects that include CNG stations.

Mohammed maintains that CNG represents a more practical alternative to electric vehicles for Tanzania given the country’s existing vehicle fleet, domestic gas production, and power infrastructure limitations.

For job seekers interested in this growing field, specialized certification in CNG retrofitting, welding, and safety provides the most direct path to employment with conversion companies like Kleenair, which reports having technicians with over 16 years of experience in the field.

3. New Partnership Brings National Lottery to Mobile Money Users

Mixx by Yas has become the first mobile financial service (MFS) provider to partner with the National Lottery of Tanzania. Hence, creating a new digital pathway for lottery participation.

The deal, announced at a signing ceremony in Dar es Salaam, connects the lottery’s gaming platform to Mixx’s payment infrastructure, potentially reaching over 25.4 million customers across the country.

The partnership was formalized by Angelica Pesha, Chief Officer for Mixx by Yas, and Kelvin Koka, Director of Ithuba Tanzania.

For ITHUBA, which took over management of Tanzania’s National Lottery in January 2025 after investing TZS 50 billion Tanzanian shillings, the partnership is a key step in their digitization strategy. “Our collaboration with Mixx by Yas ensures that the National Lottery reaches every Tanzanian,” said Koka during the announcement.

The timing aligns with remarkable growth in Tanzania’s mobile money sector, where wallets have nearly doubled from 32.3 million in 2020 to 61.9 million in 2024.

In this competitive market, Mixx holds a 19% market share, positioning it as the third-largest mobile money provider behind M-Pesa (39%) and Airtel Money (31%). The new venture could help Yas strengthen its position while giving Ithuba Tanzania access to an established digital payment network.

The National Lottery, now under Ithuba’s management, has promised to create 2,000 jobs and distribute over TZS 120 billion in prizes through various games in 2025.

When the South African company won the tender in May 2024, beating 18 other businesses, it committed to modernizing the lottery experience while contributing to community development.

For everyday Tanzanians, the partnership means lottery games become accessible through mobile phones rather than physical tickets.

The Gaming Board of Tanzania (GBT) will monitor operations to ensure transparency and fair play—critical factors for maintaining public trust in both the lottery system and the electronic cash platforms that facilitate it.

4. CRDB, UNDP Connect SMEs to African Trade Opportunities

The CRDB Bank Foundation and UNDP Tanzania have launched a guide helping small and medium-sized businesses navigate the African Continental Free Trade Area (AfCFTA), which has over 1.3 billion people with a combined GDP of approximately $3.4 trillion.

At the Dar es Salaam launch event, Deputy Minister of Industry and Trade Exaud Kagahe highlighted Tanzania’s strategic commitment to the trade agreement.

“The government recognizes the benefits of the AfCFTA, which is why our Parliament ratified the agreement in September 2021, making us eligible to benefit from the African Free Market,” he said.

This initiative takes a comprehensive approach to supporting businesses.

According to CRDB’s Startup Development Manager Sharon Nsule, the initiative includes regional training programs, SME assessment, and targeted assistance with export market access.

While financing options are available for qualifying businesses ready to scale across the continent, the program recognizes that many entrepreneurs benefit significantly from improved market information and guidance.

Swahilies, a Tanzanian fintech serving over 6,000 businesses, provides support with digital tools for business management. “Our platform helps SMEs prepare effectively for AfCFTA opportunities,” said John Haule, CEO of Swahilies.

During the event, Swahilies trained and began onboarding 500 SMEs to its digital platform, which offers inventory management, sales tracking, expense monitoring, and customer relationship tools.

The platform also facilitates debt collection and provides various payment solutions, including mobile money and card transactions.

UNDP’s simplified AfCFTA guide introduced at the event provides essential information on trading requirements, including documentation needs, import/export procedures, and strategies for accessing continental markets.

It specifically addresses common challenges faced by small traders, including limited awareness of trade requirements and operational capacity constraints.

UNDP Tanzania Resident Representative Shigeki Komatsubara emphasized the transformative potential of the trade agreement.

"The AfCFTA, as the largest trade zone in Africa, presents immense opportunities to increase intra-African trade, attract investment, and drive socio-economic transformation, particularly for women," he noted.

Tully Esther Mwambapa, Managing Director of CRDB Bank Foundation, stressed the importance of empowering MSMEs as a crucial part of Tanzania’s economy.

“We are committed to supporting the growth and competitiveness of Tanzanian SMEs by providing the tools, resources, and training necessary for success in the AfCFTA market,” she said.

The initiative includes collaboration with key institutions like the Tanzania Revenue Authority (TRA), Tanzania Chamber of Commerce, and the Tanzania Bureau of Standards (TBS) to ensure SMEs receive comprehensive support for continental market entry.

This Dar es Salaam event follows similar launches in Arusha, Mwanza, and Mbeya, indicating a nationwide effort to position Tanzanian businesses for broader African trade participation.

5. Medical Supply Chain Startup Seeks $1M, Launches Maternity Kit

Imagine an Africa where no health facility has to turn away patients because they couldn’t afford to stock up. That’s the future Dawa Mkononi is working toward.

In many low- and middle-income communities, hospitals, pharmacies, and clinics struggle to access essential medicines. The reason is not only supply issues but also financing and logistical challenges. Dawa Mkononi is changing that by making medical supplies more accessible and affordable.

At this stage, they are taking a critical next step. The company is raising a $1M extension of their seed round to accelerate growth and expand their impact.

This fundraising announcement comes alongside the launch of SereniKit, their first product—a redesigned maternity kit that addresses common childbirth challenges with Swahili instructions, better materials, and an e-vaccine reminder system.

What new funding will unlock

Scale operations: Dawa Mkononi will reach more clinics, pharmacies, and other healthcare facilities.

Light CAPEX: Investments in logistics and fulfillment will ensure faster and more efficient deliveries.

Research & technical development: Improved credit financing and inventory systems will make medical supplies more accessible.

A turning point for healthcare access

This investment will drive 30% growth in their client base, bringing affordable medical supplies to more communities. It will also help Dawa break even and secure a $2M financing partnership with a bank, which will unlock critical credit access for healthcare providers.

For investors looking to back a mission-driven company that is solving a real and urgent problem, this is the moment to get involved.

Beyond building a valuable business, Dawa Mkononi is helping create a future where no health facility has to choose between saving lives or staying afloat.

6. Startup HARAMBEE Showcases Tanzanian Innovation

The 7th Serengeti Business Angels Network (SBAN) Startup HARAMBEE Evening gathered entrepreneurs, investors, and business professionals in Dar on March 7.

The event featured three-minute pitches from promising startups, followed by seven-minute Q&A sessions exploring their scaling plans.

Ghala, founded by Kalebu Gwalugano of Neurotech Africa, emerged as the winner, securing TZS 1.42 million from gate collections. His platform leverages WhatsApp to help merchants automate order management and payments.

“The goal is to support those who pitch, help the audience understand what these companies are doing, and provide business development support,” Rodrique Msechu, SBAN co-founder, told Atoms & Bits. “It is more about community support than just funding.”

ClickPesa, on the other hand, presented its fintech platform addressing daily challenges faced by microfinance institutions (MFIs) in Tanzania.

The startup helps lenders move beyond manual, paper-based transaction tracking while enabling SMEs to manage financial operations more efficiently.

GawaPay introduced its rent payment solution that allows tenants to pay monthly while landlords receive full annual payments upfront.

The platform uses AI-powered risk assessment for approvals and offers a rewards system for on-time payments that helps tenants build credit and potentially unlock mortgage opportunities.

Francis Omorojie, Ennovate Ventures CEO and SBAN member, described the event as “Tanzania’s most interactive platform connecting startups and early-stage investors,” focused on “meaningful conversations and ecosystem building.”

The event attracted about 70 attendees, including ecosystem stakeholders from the Netherlands Embassy.

John Mike, representing the embassy, expressed enthusiasm about Tanzania’s fintech sector, noting that these ventures now constitute a highly active component of the country’s startup scene.

After the structured program, attendees engaged in two-hour intensive breakout sessions with founders.

Networking continued beyond the scheduled time, with many participants staying an hour later to continue conversations.

7. Key Takeaways from the Mastercard Africa Leadership Summit 2025

London played host to the Mastercard Africa Leadership Summit 2025, bringing together influential figures from the global financial sector to discuss the future of finance on the African continent.

Among the key participants were Ruth Zaipuna, CEO of NMB Bank, and Filbert Mponzi, Chief of Retail Banking, who represented the bank at this prestigious gathering of industry leaders.

The summit provided a critical platform for discussions on the rapid growth of Africa’s digital payment sector, which is set to rise from $40 billion in 2020 to more than $110 billion by 2025.

With a focus on financial inclusion, digital payments, and secure banking solutions, the summit highlighted the opportunities for collaboration among financial institutions, technology companies, and regulators across the continent.

A central theme of the summit was the need for seamless financial services that can better serve both individuals and businesses, particularly in the context of cross-border payments and the integration of digital technologies into everyday banking.

The discussions stressed the importance of strategic partnerships in addressing those challenges and accelerating the adoption of financial technologies that could benefit millions of Africans.

The summit was also a reminder of the intersection between finance, creativity, and culture, as Mastercard’s sponsorship of The BRIT Awards 2025 showcased how the financial sector can play a role in supporting diverse industries.

This convergence of sectors offered a broader perspective on the influence of financial institutions beyond traditional banking.

NMB Bank’s participation at the summit reflects the growing importance of African financial institutions in global conversations about the future of finance.

With a shared focus on advancing financial inclusion and creating seamless banking experiences, the discussions in London are set to drive the next wave of transformation in Africa’s financial landscape.

8. Founders School Addresses Tanzania’s Startup Skills Gap

A new training program launched in Dar es Salaam aims to transform aspiring entrepreneurs into successful company builders through hands-on mentorship from established business leaders.

Founders School, which opened applications for its first cohort in August 2024, takes a practical approach to startup education rarely seen in East Africa.

Sahara Ventures, the company behind this initiative, has built its reputation on fostering Tanzania’s innovation ecosystem since 2016.

Founded with a mission to create a stable technology and entrepreneurship environment in Africa, the group has expanded to include consulting services, a corporate accelerator, and Sahara Sparks—a major event in East and Central Africa.

“Most of us, when we were starting our founding journey, lacked sufficient resources and mentoring to build our ventures,” explains Jumanne Mtambalike, CEO of Sahara Ventures.

“Founders School aims to address that by equipping aspiring founders with resources and knowledge they need to build great companies.”

The school structures its curriculum around three distinct entrepreneurial phases:

Aspiring Founders (turning ideas into products), Building Founders (developing businesses around prototypes), and Scaling Founders (growing established ventures).

Each track addresses specific challenges entrepreneurs face at different stages.

“We believe anyone can be a founder, and the skills required to build a business are needed in many industries and sectors,” Mtambalike notes.

The program employs what he calls a “multi-competence, project-based, and challenge-based learning approach” focused on developing the “4Cs”: Critical Thinking, Communication, Collaboration, and Creativity.

What distinguishes this initiative from traditional business education is its faculty of practicing entrepreneurs. The teaching team includes established local founders like Musa Kamata (Sahara Ventures), Albany James (Anzisha Ventures), and Brian Paul (Studio19), who share battle-tested knowledge rather than theoretical concepts.

The Tanzania Commission for Science and Technology (COSTECH) went further to recognize Sahara’s “Skills Enhancement for Founders Program” at its 9th STICE exhibition. Thus highlighting Founders School’s potential impact on the local innovation ecosystem.

This locally built approach to entrepreneurship education at TZS 500,000 (~$193) per participant addresses specific regional challenges that global programs might overlook.

It is helping create a stronger pipeline of well-prepared founders ready to build solutions for local markets.

9. Beem Joins Tech Heavyweights at MWC 2025

Tanzanian technology company Beem made its appearance at Mobile World Congress (MWC) Barcelona 2025.

It stood alongside global giants at telecom’s premier event, which drew over 109,000 attendees from 205 countries this year.

CEO Taha Jiwaji announced key account manager Ali Nanji would represent the company at the event, inviting industry peers to “learn about all things mobile and communication across Africa and discuss any partnership opportunities.”

Beem’s presence put a Tanzanian innovation on the global stage, where over 2,900 exhibitors showcased their technologies from March 3-6.

Founded in 2011, Beem has built its reputation on streamlining business-customer communication across African markets.

The company processes over 1 billion transactions for more than 5,000 customers across 24 countries, leveraging more than 60 mobile networks.

At MWC, Beem highlighted its flagship product, Moja, which provides businesses with a unified inbox for customer communications across WhatsApp, Instagram, and Facebook.

This solution has proven valuable for companies like Azam TV by centralizing customer inquiries from multiple channels into a single dashboard.

“We have created an integrated communications and financial services platform,” Jiwaji previously told Atoms & Bits. “We believe mobile technology will help enterprises drive growth and commerce in Africa.”

The timing of Beem’s MWC appearance is notable as conversational commerce gains momentum globally.

With 56% of MWC attendees coming from adjacent industries beyond traditional telecom, the event offered Beem opportunities to connect with potential partners from diverse sectors.

If you operate a business in mobile-first markets like Tanzania and Kenya, Beem can help you:

Reduce communication costs

Improve service efficiency, and

Enable rich customer interactions through familiar channels like WhatsApp.

10. New Digital Platform Brings Transparency to Charity Donations in Tanzania

Qatar Charity has partnered with Sarafu and AzamPesa to create a transparent digital system for distributing aid to orphans in Tanzania. Their goal? Eliminating cash handling and providing detailed visibility into how donations are spent.

The system works through a multi-step process that keeps donors informed at every stage.

First, Qatar Charity registers beneficiaries on both AzamPesa (a telco-independent mobile money platform) and Sarafu (an e-commerce and delivery service).

The charity then specifies which products each beneficiary can order using designated funds.

AzamPesa creates restricted wallets that can only be used for Qatar Charity-approved purchases on Sarafu.

When funds are loaded, beneficiaries can order what they need within these parameters, with Sarafu delivering directly to their homes.

“It is not enough to transfer the payments to beneficiaries; what is required is a full view of the transaction process where cash handling is entirely eliminated from every step of procurement,” explains Firas Ahmad, a leader behind the initiative.

Sarafu Disbursement’s key innovation is its complete transparency.

Qatar Charity can track every transaction down to the specific items ordered, their delivery status, and timing. Unused funds can be recovered and reallocated to other beneficiaries, ensuring 100% of donations directly support those in need.

This approach demonstrates how digital solutions can create value impossible with analog alternatives.

For Qatar Charity, maintaining visibility on disbursements without this technology would be nearly impossible.

The same system has applications beyond charity work. Businesses struggling with procurement oversight can use it to track departmental spending, while companies can gain transparency into contractor purchases throughout their supply chain.

For Firas, who personally supports an orphanage in Goba, Dar es Salaam, this project aligns with his broader vision of using technology to improve lives in Tanzania.

“The core vision of this ecosystem of businesses we built revolves around greater transparency, trust, and efficiency in the country,” he notes.

Qatar Charity’s partnership with Sarafu showcases how Tanzania’s digital infrastructure is maturing to solve complex problems through integrated payment and e-commerce solutions.