We’re back with the week that was.

In this edition, we spotlight our latest magazine issue, M-Kadi’s digitization of two major events, and BoT’s endorsement of a startup competition.

Plus seven more updates from across Tanzania’s tech sector.

This roundup is brought to you by Techsoko.

The Boox Note Air 4C is their flagship offering this month.

At Sh1.47 Mn, this e-ink tablet is ideal for note-taking, document annotation, and creative work.

Visit techsoko.co.tz to order.

FIRST, WATCH THIS

Our first exclusive video connects you to five industry leaders who discuss the customer experience challenges their companies face today.

Executives from Stanbic Bank, Azam Media, Mkombozi Commercial Bank, Vodacom Tanzania, and Selcom PayTech share insights on service delivery pain points and hint at solutions they’re seeking.

This snapshot of industry perspectives highlights common themes across banking, media, and telecommunications sectors.

For optimal viewing, use full-screen mode on your smartphone.

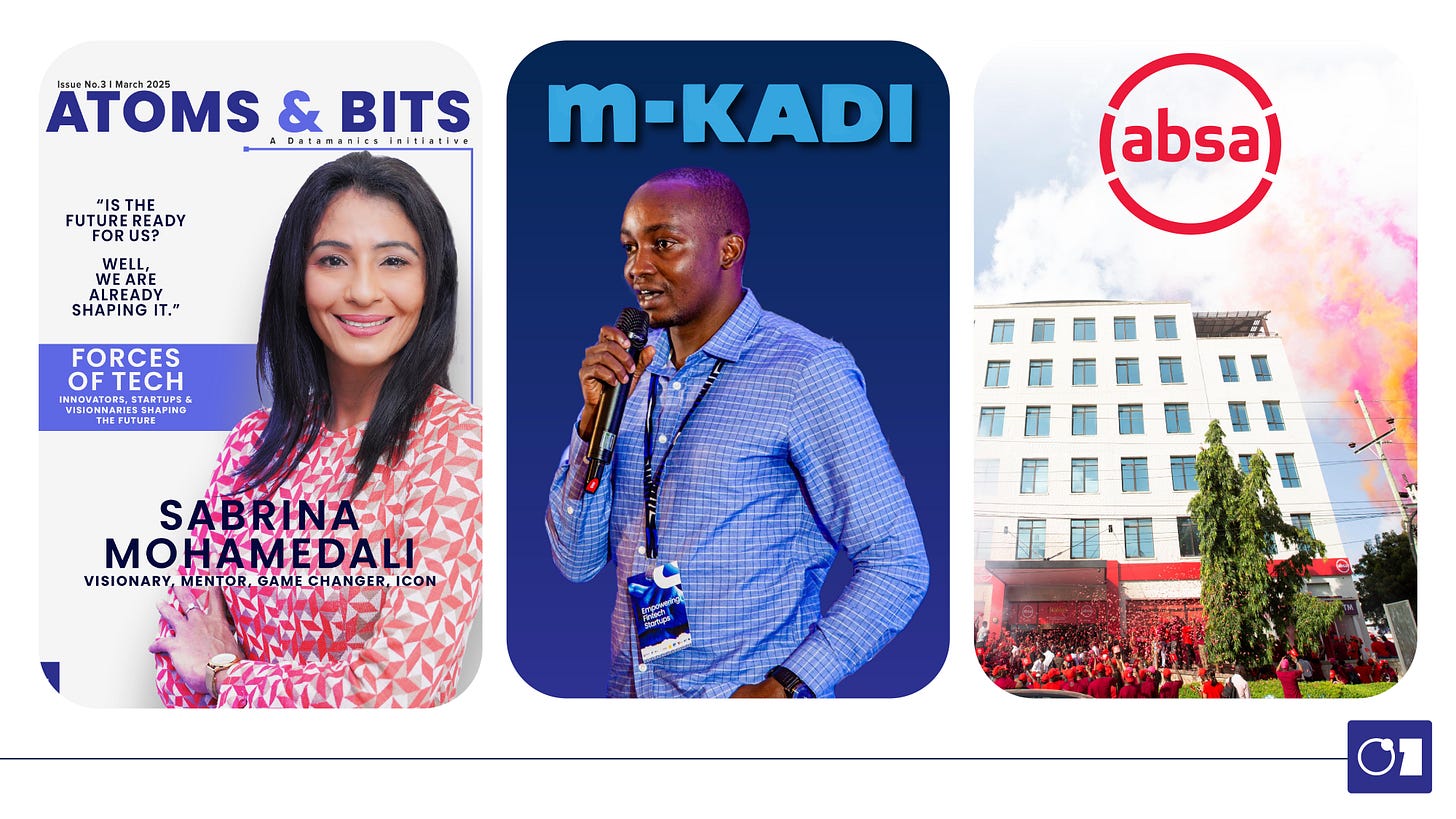

1. Atoms & Bits Releases March Issue Celebrating Women in Tech

First, some context.

Our third issue, released March 21st, connects readers directly with the women who are building and using technology that matters in Tanzania today.

The content.

We take you into Azam TV’s boardroom where Sabrina Mohamedali redefines broadcasting for phone viewers, to Cybergen Training venues where Upendo Kimbe addresses Tanzania’s technical skills gaps, to NovFeed’s laboratory where Diana Orembe turns market garbage into fish feed.

We also visit Tukutech sites where Tukupala Mwalyolo’s drones map mines and spray farms.

In Zanzibar, women with disabilities gain independence by operating electric rickshaws, showing technology’s power to transform lives.

Fact.

The digital flipbook is available free on Issuu while print copies reach 800+ organizations nationwide.

What’s ahead?

We’ll continue to provide market intelligence through our magazine, newsletter, research reports, and audiovisual content.

Our goal is to help you identify opportunities and avoid costly mistakes in emerging markets.

2. M-Kadi Provides Digital Cards for GSM, Wasafi Event

First, some context.

M-Kadi delivers electronic invitation services for Tanzanian events. It replaces traditional paper cards with mobile-accessible alternatives.

Last week, the startup managed two high-profile gatherings in Dar es Salaam: a 700-guest Wasafi event and a major fundraiser.

The events.

At the Super Dome on March 14th, M-Kadi’s system helped GSM Foundation partner with CCBRT, Yanga Football Club, the Ministry of Health, Clouds Media Group, and AZAM Media to raise Sh1.1 billion.

These funds will provide treatment for 400 children born with clubfoot. The separate Wasafi iftar event utilized digital cards for all 700 attendees, enabling streamlined access and information sharing before and after the gathering.

“Ten such events would mean 7,000 cards. Do you have any idea how many logistical challanges and environmental damages are incurred through distributing 7,000 paper cards to invitees?” said Maarufu Muyaga, M-Kadi’s co-founder and CMO.

Fact.

M-Kadi has managed over 1,500 events and distributed more than 700,000 digital cards to date, according to information on their website.

What’s ahead?

M-Kadi continues to expand services including their M-Pledge system for donation collection and tracking, which they describe as “the first in the market, instantly channeling all payments to the event owner.”

3. Bank of Tanzania Endorses FinTech Startup Competition

First, some context.

Hindsight Ventures, in partnership with Absa Bank, launched the 2025 edition of Wazo Challenge at Serena Hotel on March 21st.

The program seeks technology solutions in four specific areas: seamless banking processes, personal finance management tools, customer-centric services, and digital-first financial products targeting millennial and Gen Z consumers.

It returns to Tanzania after running editions in Kenya and Nigeria, with Absa committing to host three consecutive editions through 2027.

The partnership.

BoT Director for Financial Deepening and Inclusion Kennedy Komba, officially opened the challenge, marking the first time the regulator has directly supported this fintech development program.

International speakers included Anubhav Sharma from India’s National Payments Corporation, who presented on UPI implementation for inter-bank transactions through mobile phones.

The fact.

Selected participants receive access to $600,000 in technology credits to build their solutions during the four-week bootcamp running May 5-30th.

What's ahead?

Two separate tracks accommodate both early-stage startups and new teams building prototypes, with applications open until April 18th.

Ten finalists (five from each track) will present at a demo day on June 6th, competing for partnership opportunities with Absa Bank Tanzania and potential integration with their banking systems.

Register Now: ABC of Business Storytelling Masterclass March 27, 2025 | 10:30 AM - 12:30 PM EAT | Virtual Event | Free Access—Limited Spots

ADDITIONAL HEADLINES

Innovation Hubs Invited to Partner with UNCDF

The UN Capital Development Fund launched the application process for implementing partners of Tanzania’s leading fintech accelerator (PesaTech) on March 20.

Previous cohorts (during FY 2022/23 and 2024) supported 22 fintechs, facilitated 120+ partnerships, and helped secure over $10 million in investments.

Interested organizations can apply here to run the program focused on post-revenue fintech startups seeking investment readiness and corporate partnerships.

JumlaJumla Launches Msosi Delivery App

The e-commerce platform unveiled its farm-to-fork grocery delivery application on March 19, featuring electric motorcycles and cargo bikes through partnerships with EKOglobe and ELICO Foundation.

Msosi integrates with JumlaJumla’s existing marketplace, credit, fulfillment centers, and collection points while prioritizing sustainable last-mile delivery across Dar es Salaam.

Swahilies Expands to International Payment Service

Fintech startup Swahilies is piloting a new remittance service that helps Tanzanian businesses pay overseas product suppliers.

This solves a major problem where local businesses struggle to send dollars abroad for inventory purchases due to currency shortages.

The new feature integrates with Swahilies’ existing platform that already helps 10,000+ SMEs to access non-collateral loans, track stock, and process local payments.

KilimoTech Accelerator Begins Training Sessions

The program’s bootcamp completed its first week on March 22, delivering specialized curriculum for digital agriculture innovators.

Initial sessions covered business model innovation, strategic partnerships with governments and telecoms, investor readiness, and pitch preparation.

Subsequent workshops led by Sheria Kiganjani advocates addressed intellectual property (IP) protection for software solutions, while Sukuma Pixel facilitated user experience design specifically for low-literacy farmers.

The ongoing curriculum specifically addresses mechanization challenges in Tanzania, where smallholders cultivate 85% of agricultural land and represent 65% of the rural workforce.

Funguo Program Conducts Monitoring Visits to Funded Startups

Representatives from UNDP Tanzania and implementing partner Anza Entrepreneurs conducted site visits last week to evaluate progress at their investees’ offices.

The team assessed digital ticketing platform Otapp and healthcare supply chain company MedPack, both recipients of the Funguo/Imbeju funding initiative.

FUNGUO, supported by the European Union and UK government, has invested Sh3.8 billion in 42 startups across Tanzania to promote innovation and create employment opportunities for women and youth.

Vodacom to Expand Visa Partnership

The telecom company met with Visa Group management on March 19, led by Andrew Torre (Regional President), to explore future digital payment opportunities.

Their existing collaboration has already enabled virtual cards on the M-Pesa platform, allowing users to make international online payments via a 16-digit virtual card linked to their mobile wallets.

The companies discussed potentially expanding merchant acceptance networks and increasing financial inclusion across Tanzania through additional fintech innovations.

ICT Ministry Launches National Startup Policy Consultations

The government has begun formal stakeholder engagements for the country’s first dedicated startup policy framework, following an initial forum in Arusha on March 15.

Minister Jerry Silaa attended the session, reaffirming commitment to creating an enabling environment for entrepreneurs.

The Tanzania Startup Association (TSA), which advocated for the policy development, called for broad participation and highlighted the need for a national venture capital fund (NVCF). Consultations will continue with additional regional forums through April.

Register Now: ABC of Business Storytelling Masterclass March 27, 2025 | 10:30 AM - 12:30 PM EAT | Virtual Event | Free Access—Limited Spots