This Week in Tanzanian Tech [June 8-14, 2025]

Here’s what caught our attention lately:

A new fintech is converting digital currencies into mobile money

Agriculture experts are planning a startup competition

Business angels have discovered tax layers that reduce investment returns

We also highlight 7 other important headlines.

Event Spotlight

Ready to connect with innovators and investors? The Zanzibar Tech & Investment Summit 2025 runs July 3-5.

Secure your spot here.

1. NEDA Labs Launches Stablecoin Payment Platform

The growing market.

When Ethiopian businesses watched their currency lose 30% of its value in July 2024, many turned to stablecoins (a type of digital currency) to preserve their money’s worth.

This shift helped stablecoins capture 43% of all cryptocurrency transaction volume across Sub-Saharan Africa by December 2024.

Nigeria now processes $3 billion quarterly in stablecoin payments while Kenya doubled its usage last year.

These digital versions of real currencies help people avoid expensive transfer fees and currency fluctuations while doing business across borders.

What NEDA Pay offers.

Blockchain startup NEDA Labs emerged from stealth mode last week, supporting digital currencies from 12 countries including the US, UK, France, Canada, China, and Brazil.

Unlike traditional money transfers that require agents or bank branches, NEDA Pay lets you convert currencies directly through your own account.

You can send and receive money locally or internationally using USDC (US dollars), cNGN (Nigerian naira), ZARP (South African rand), and EURC (euros), with a digital Tanzanian shilling (TSHC) potentially joining soon.

You convert earnings to Tanzanian shillings and withdraw to your mobile wallet or bank account.

The platform also lets you:

Create payment links and invoices in under 60 seconds

Track transaction performance

And analyze your financial data through a single dashboard

How users benefit.

Traditional international transfers cost 6-10% and take days to process.

NEDA Pay eliminates these delays and reduces costs significantly across Tanzania, Kenya, Uganda, Nigeria, Ghana, and West African franc zones.

Creators, freelancers, or business owners owners can generate payment links instantly and collect money from customers anywhere.

The funds appear in their local accounts without waiting for bank processing times.

Recognition.

NEDA Pay recently won Base Batch 001, a major global startup competition backed by Coinbase (the world’s most regulated digital asset exchange).

NEDA took first place in the Africa stablecoins track, competing against other fintech startups.

This recognition shows the platform has been tested and validated by industry experts before launching to the public.

Zoom out.

Globally, stablecoins moved $27.6 trillion worth of payments in 2024. They handled more money than Visa and Mastercard combined.

With over 40 million mobile money ‘users’ and around 12 million bank account holders, Tanzania shows strong potential for digital currency adoption.

Getting started.

You can sign up immediately at nedapay.xyz.

NEDA Labs is currently expanding mobile money partnerships, building merchant analytics tools, and speeding up bank withdrawal times while pursuing regulatory approval for TSHC to complete its local currency offering.

2. Stakeholders Map Agritech Gaps

The moment of truth.

When Dr. Mustapha Almasi stood before 100+ innovation leaders at Four Points by Sheraton, he delivered news that silenced the room.

His presentation on Tanzania’s agritech ecosystem revealed that 75% of startups remain stuck at pre-revenue stages.

Or, in other words, many youth have brilliant ideas that never reach the farmers they promise to help.

The Italian Ambassador and Deputy Permanent Secretary for Agriculture watched as the perception of Tanzania as Africa’s ‘most promising’ agritech market came under scrutiny.

What happened in the breakout rooms.

Facilitators moved between three discussion groups on the seventh and second floors.

Conversations with startup founders, researchers, and development partners focused on:

Aligning agritech innovation with national policy priorities

Scaling solutions through multi-stakeholder collaboration

And setting innovation agendas

The sessions generated insights about gaps between current support systems and what entrepreneurs actually need, while exploring how different actors could work together more effectively to move innovations from concept to farmer adoption.

The honest talks.

During the panel discussion, moderator Margareth Geddy from the Tanzania Startup Association (TSA) pressed speakers on why support systems keep failing.

Rose Funja from AltitudeX acknowledged that funding and mentorship alone won’t bridge the valley between research and profitable businesses.

Terry Ikunda from the Agriculture Non-State Actors Forum (ANSAF) explained how farmer organizations see countless startups making promises but delivering little measurable impact on productivity or incomes.

Designing differently.

CGIAR Alliance’s Claudia Zaccari and partners including TARI’s Dr. Sophia Kashenge-Kilenga are co-creating the AgriTech4Tanzania Innovation Challenge specifically for startups with working solutions, not simply concepts.

Unlike traditional incubators that might accept anyone with an idea, this program will target specific crop and process value chains where innovation can demonstrate:

Clear farmer adoption

Income improvements

Environmental sustainability

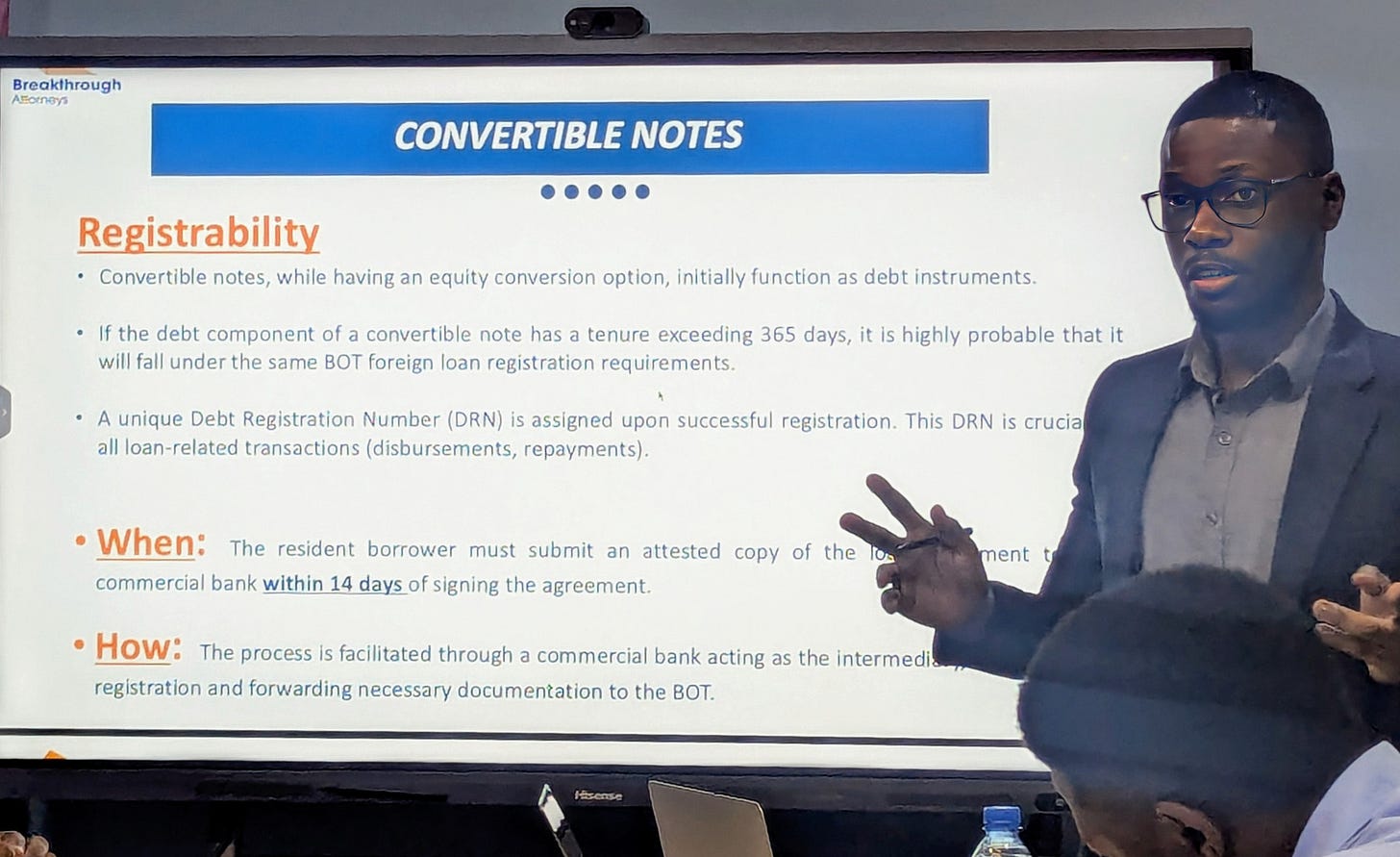

3. Angel Investors Learn Tax Rules

Reality check.

You might think angel investing means writing a check and collecting profits when startups succeed.

But when experienced investors gathered for SBAN’s recent masterclass, they discovered startup investing involves layers of tax rules and regulatory requirements that can dramatically affect final returns.

Two ways to get your money back.

Tax experts from Breakthrough Attorneys started with fundamentals that affect every investor.

When you put money into a company, there are only two legal ways to get it back later.

You can:

Receive dividends when the company distributes profits to shareholders.

Sell your ownership stake to another investor or company.

These might sound similar, but Tanzania’s tax system treats them completely differently, affecting how much money you actually keep.

The smart founder’s strategy.

When you start a company, don’t give yourself 100% of the shares right away.

Instead, keep some shares unallocated so you have room for investors later.

Fact.

When Tanzanian companies make profits, they first pay 30% corporate tax.

If they distribute remaining profits as dividends, investors pay another 10% withholding tax.

For angel syndicates like SBAN, additional layers emerge since the syndicate itself becomes a taxable entity.

When syndicates distributes returns to individual investors, this also triggers 30% personal income tax obligations.

Understanding these layers helps investors plan realistic return expectations.

Cross-border complications.

For investments in other countries, the tax situation becomes more complex.

Investors may face obligations in both the startup’s home country and Tanzania when bringing money back.

Without double taxation treaties (DTTs), the same profits get taxed twice.

The regulatory obstacles.

When investors provide interest-bearing loans to startups, the Bank of Tanzania may require lending licenses depending on structure and frequency.

Interest rates above 10% face additional regulatory scrutiny.

For startup acquisitions exceeding Sh3.5 billion or large share purchases that influence company control, the Fair Competition Commission (FCC) requires approval processes taking 5 to 90 days.

These time frames can cause deals to collapse while investors wait for government clearance.

The call for reforms.

Discussion participants agreed that current regulations create challenges for early-stage investment.

Existing rules were designed for large established companies, not small growing businesses.

We encourage continued dialogue between investors, entrepreneurs, and policymakers to create frameworks that truly support Tanzania’s startup ecosystem.

ADDITIONAL HEADLINES

Dawa Mkononi Opens New Office

The pharmaceutical e-commerce company has started operating directly in Zanzibar, its third-highest revenue region.

Previously, hospitals, pharmacies and clinics waited three days for medicine deliveries from the mainland.

Now, DM delivers in three hours.

Startup Africa Roadtrip Opens Applications for Tanzanians

Italian non-profit BeEntrepreneurs has launched applications for its Next Generation Africa 2025 program.

The five-day bootcamp runs August 11-15 in Dar, selecting 25 East African startups for intensive training and mentorship.

Top performers win an all-expenses-paid trip to Italy in 2026 to pitch to European investors and innovation hubs.

Digital Africa to Host Startup Networking Event

The French initiative has announced its June 24 gathering will run from 6:30-8:30 PM in Dar es Salaam.

Digital Africa operates FUZE, an investment program providing €20,000 to €100,000 funding for early-stage African startups across eight sectors including health and fintech.

Selected companies will pitch to the organization’s fund CEO during June 23 training sessions preceding the networking event.

PAWA Joins Global AI Program

Tanzanian startup Sartify will receive hardware access, mentorship, and partnership opportunities from NVIDIA to expand its small language model (PAWA) across the continent.

PAWA helps businesses build custom AI assistants that understand local languages like Swahili without requiring coding skills.

NileAGI Cuts AI Development Costs

Dar-based NileAGI has introduced software that lets enterprises create their own AI assistants and automated systems on regular office computers instead of expensive specialized processors (costing $15,000 to $40,000 per unit).

Unlike using ChatGPT or other external AI services that charge monthly fees and send data overseas, you can now build private AI tools that understand your specific business needs.

MazaoHub Receives Philanthropic Investment from Elea

The agritech startup will use funding to expand its network of Farmer Excellence Centers across Tanzania.

MazaoHub has tested over 205,000 soil samples and serves 66,000 farmers while launching CropSupply, a digital marketplace connecting verified farmers directly to buyers and exporters.

Tukutech Selected for Continental Accelerator Program

The UNDP’s MineTech Hub has chosen innovators from across Africa for its mining technology accelerator in Solwezi, Zambia.

Tanzania’s leading drone startup Tukutech joins companies from nine other African countries in the program.

The shortlisted companies are working on solutions for waste management, operational efficiency, and environmental sustainability.