Another week in the books!

Today, we:

Explore what’s inside our latest magazine issue

Break down what it takes to build a billion-dollar Tanzanian company

And spotlight the latest fintechs licensed by BoT

We also cover seven other headlines, including Tanzanian-led innovations competing for Africa’s biggest engineering prize.

Pre-Dive

Cybergen runs its Monitoring, Evaluation & Learning (MEL) workshop from June 16–20 in Dar es Salaam, targeting professionals who use data for impact measurement. Register here.

1. A&B Shows How Tanzania’s Transport Sector is Changing

What we covered.

Our latest magazine issue looks at how technology affects the way Tanzanians travel and move goods.

We found three-wheeler drivers saving Sh200,000 monthly by switching to cheaper gas instead of petrol.

Bus tracking devices helped cut deadly crashes from 117 in 2021 down to 102 by late 2022. Electric bajajis can cost Sh2,900 daily to run versus Sh21,900 for petrol.

The numbers.

Drivers who convert to compressed natural gas (CNG) pay Sh1.5 million upfront but save half their fuel costs every month.

Over 5,000 upcountry buses now have tracking devices that beep when drivers speed and alert control centers.

Tanzania’s 22 airports, on the other hand, have created 710,000 jobs and bring in $3.8 billion yearly through flights connecting 29 countries.

Mobile money platforms processed Sh199 trillion last year through 63.2 million accounts and 1.3 million digitized merchants nationwide.

Fact.

Ride-hailing apps like Bolt grew 106.3% as digital taxis reached 2,781 vehicles across Tanzania’s regions.

More inside.

We talked with Bolt’s boss who runs operations across three East African countries.

Zanzibar wants half its students learning to code by 2050. Techsoko mixes online sales with a physical shop in Dar.

Plus stories about making cooking fuel from farm waste and growing better bananas in labs.

Click here to read on.

2. NMB Bank Becomes Tanzania’s Second Billion-Dollar Company

The milestone.

NMB now sits alongside Tanzania Breweries Limited (TBL) as one of only two companies on the Dar es Salaam Stock Exchange (DSE) worth over $1 billion (2.7T).

The bank reached this level by growing faster than any other financial institution in the country.

It added 1.5 million customers in 2024 alone to reach 8.6 million total accounts.

How they built it.

NMB focused on scale rather than premium services.

It added over 22,000 banking agents just last year, bringing its total to 50,998 across Tanzania. These agents, working from corner shops, bus stations, and small businesses, handle deposits, withdrawals, and bill payments so customers don’t need to visit bank branches.

Nevertheless, the bank continues operating 241 traditional branches alongside its expanded agent model.

This physical network has helped NMB become Tanzania’s largest bank by customer base.

It now processes 96% of transactions through digital channels, keeping costs low while serving millions of people. Customer deposits grew 13% to reach Sh9.56 trillion in 2024.

The bigger picture.

Tanzania has several companies that likely exceed billion-dollar valuations but remain private.

Mohammed Dewji’s METL Group spans 11 countries with operations in textiles, flour milling, and beverages.

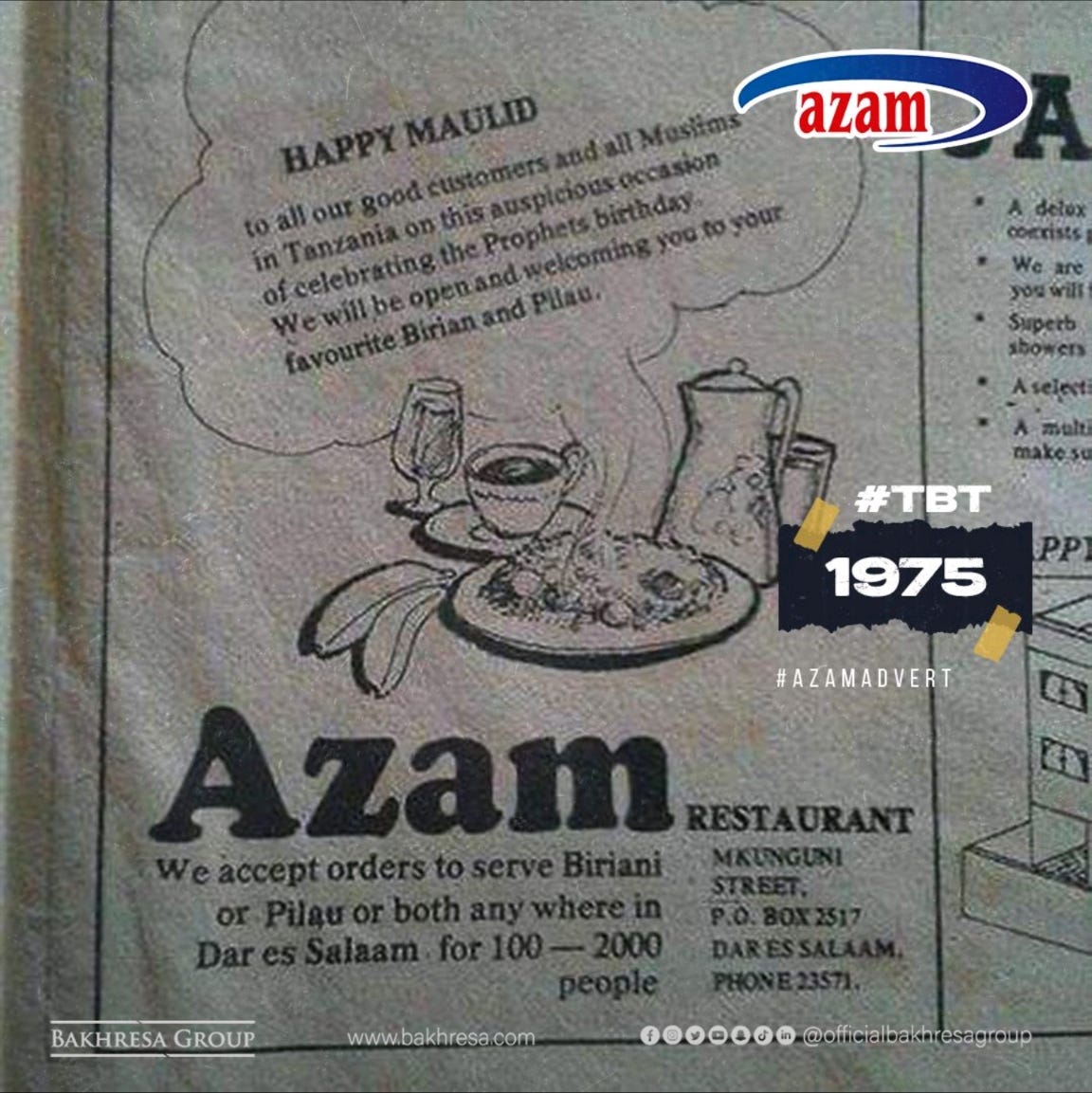

Said Bakhresa built a conglomerate from food processing to media across ten African countries.

These private companies can grow without stock market scrutiny, while public companies like NMB and TBL must report their progress quarterly.

What’s working.

NMB earned Sh647 billion profit after tax (PAT) in 2024, up 19% from 2023.

From this profit, the bank will allocate Sh214 billion to dividend payments, returning about 33% of PAT to shareholders.

The remaining 67% will go toward other business needs like expansion, debt payments, cash reserves, and operational investments.

Shareholders will receive Sh429 per share starting June 19, up from Sh361 the previous year.

This compares favorably to TBL, which had earnings per share of Sh99 in Q4 2024 and historically paid Sh255 per share in dividends back in 2021.

Beyond financial performance, shareholders have encouraged NMB to expand outside Tanzania. “The board is now evaluating this prospect,” said CEO Ruth Zaipuna at a press conference on June 5.

They will also continue investing Sh46 billion annually in technology to support their NMB Mkononi mobile platform as more Tanzanians adopt digital banking.

3. BoT Licenses New Wave of Fintech Companies

What’s happening.

The Bank of Tanzania licensed several new fintech companies recently as part of efforts to reach 80% financial inclusion by 2028.

Currently only 22% of Tanzanians have bank accounts, while 76% access some form of financial services including mobile money through AzamPesa, Mixx by Yas, and Airtel Money.

The new players.

Three companies have received Payment System Provider (PSP) licenses from BoT this year so far.

Fincra, a pan-African payment company, will help businesses collect payments in Tanzanian shillings and send money across African borders without using expensive international banking routes.

Tuma Ventures, already licensed in the UK, focuses on helping East Africans living abroad send money home to their families.

DEEM Finance takes a different approach, providing loans specifically for electric motorcycles and three-wheelers to help drivers switch from petrol vehicles.

“Tanzania’s growing digital economy and its national push for greater financial inclusion make it a strategic market,” explained Fincra’s marketing team.

The company can, for example, now help a Nigerian business expanding to Tanzania collect payments locally instead of routing money through European or American banks, which typically costs 8.9% more for cross-border transfers within Africa.

Why this matters.

Tanzania currently has 62 registered banks and financial institutions serving a population where less than 40% of adults hold formal accounts.

BoT Deputy Governor Sauda Msemo notes that our banking services reach just 1 in 5 people, creating space for fintech companies to fill gaps.

That’s why the central bank has reduced requirements for financial service agents to make banking more accessible in remote areas.

Looking ahead.

These licenses support BoT’s goal to modernize payment infrastructure and reduce transaction costs.

DEEM Finance plans to lease over 1,200 electric vehicles this year, while cross-border payment companies like Fincra and Tuma expect to capture business from SMEs, feelancers and Tanzanians working abroad who send money home to family members.

SPECIAL FEATURE

Four Tanzanians Shortlisted for Africa’s Biggest Engineering Prize

Paschal Kija Develops Life-Saving Device

The medical student from Muhimbili University designed Mkanda Salama, a belt-like device that prevents mothers from bleeding to death after childbirth.

The device massages the uterus and applies pressure to stop excessive bleeding, requiring minimal training to use.

Over 500 people have already used Mkanda, which proved to be 85% effective after testing with 120 women.

Editha Mshiu Creates Electricity-Free Cold Storage

The innovator has developed FreshPack, a cold storage solution inspired by human skin that keeps produce (fruits/vegetables) fresh without electricity.

The system uses phase change materials to maintain low temperatures, helping farmers reduce food waste in areas without reliable power supply.

Edgar Tarimo Converts Plastic Into Lumber

His Eco Plastic Wood innovation transforms discarded plastic waste into high-quality building materials and furniture.

The process addresses both waste management and construction material shortages while creating affordable alternatives to traditional wood products.

Shabo Andrew Designs Smart Electricity Meter

The Smart Luku device allows individual tenants in shared buildings to measure and pay for their own electricity consumption.

Tenants can also share electricity with neighbors through the system. It solves common billing disputes in apartment buildings and shared accommodations.

Award Details

The Royal Academy of Engineering’s Africa Prize for Engineering Innovation (APEI) will award the winner £25,000 (Sh73.7Mn), with three runners-up receiving £10,000 (Sh29.5Mn) each.

The 16 finalists from seven African countries attended a boot camp in London in March. Winners to be announced later this year.

ADDITIONAL HEADLINES

Government Funds Mental Healthcare Innovation

Last week, the Tanzania Commission for Science and Technology (COSTECH) allocated Sh150 million to establish an AI for Mental Health Research Lab at the University of Dodoma (UDOM).

This comes as the government has been pushing more technology research. It has now registered over 2,200 researchers and 480 innovators while helping set up innovation centers at nine universities.

COSTECH has also recently secured $300,000 in additional research funding from 19 partnerships with private companies.

Mastercard Partners with Equity Bank Tanzania

Equity customers can now access premium debit cards with higher transaction limits and travel benefits.

The Gold and World tiers target high-income professionals seeking superior banking services beyond standard account offerings.

Tanga Gets East Africa’s Biggest Cooking Gas Terminal

Singapore-based Petredec and homegrown ASAS Group have started building a facility to store and distribute liquefied petroleum gas (LPG) across Tanzania and neighboring countries.

The $100 million project will handle large ships and employ 2,000 workers when operational in 2027.

Beyond cooking, LPG can power industrial processes, fuel vehicles, and heat commercial buildings.