We’re back with our news roundup.

Today, we look at:

East African companies that generate the most revenue per employee

Zanzibar’s latest summit

Tanzanian brands with the largest shares of their respective markets

Plus seven other important headlines.

Business Efficiency Tip

Tired of dollar subscriptions for email, file storage, customer management, and accounting software? Flashnet switches you to Zoho Workplace that does everything in one platform.

Call +255-659-310-909.

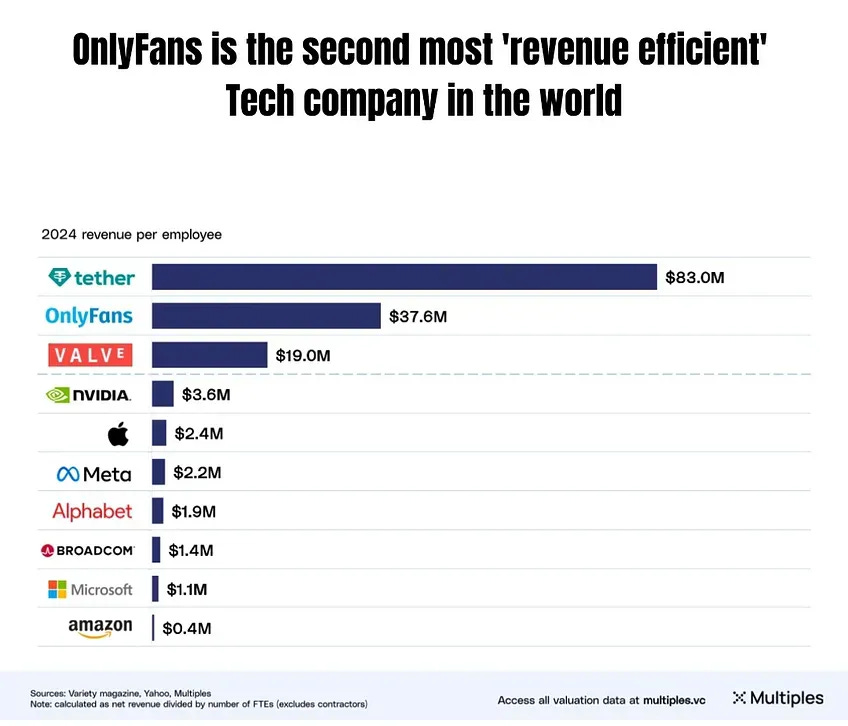

1. Companies That Generate More Revenue Per Employee Attract Better Talent

Why efficiency matters.

Whether you’re investing money, choosing where to work, or understanding how businesses perform, you need ways to compare companies.

You can:

Check if a company generates good returns on shareholder money

Look at whether a company owes too much to banks

Or measure how well companies use everything they own (assets) to generate revenue

Revenue per employee shows you something different. It reveals how much money each worker helps bring in.

The local rankings.

East African Breweries (EABL) leads at $634,115, while Tanzania Breweries (TBL) generates $496,430 per worker.

Airtel Uganda produces $464,269 per employee, and MTN Uganda reaches at $651,903.

Safaricom Group stands at $423,696 per employee through mobile money and telecommunications services.

Manufacturing giants show strong numbers too.

Bakhresa Group generates $50,000 per employee across 20,000 workers, while MeTL Group reaches $52,632 per worker with 38,000 employees.

Other metrics.

CRDB Bank shows 28% return on equity (ROE), meaning every $100 shareholders invest generates $28 profit.

NMB Bank follows at 25%.

Safaricom achieves 20% ROE with 44% profit margins, while Equity Group maintains 21% returns.

Investment impact.

Companies with higher revenue per worker typically attract more foreign investment and top talent.

They can afford competitive salaries, modern equipment, and comprehensive training programs because their operations generate more value per person employed.

Currency conversions based on December 31, 2024 exchange rates. Data compiled by Atoms & Bits.

2. Zanzibar Positions Itself Beyond Tourism

Beyond the beaches.

Zanzibar hosted 70+ tech entrepreneurs, investors, and startup founders at Fumba Town from July 3-5 for its second annual tech summit.

The event generated 600,000 digital impressions and 12,000 clicks during six months of marketing, attracting virtual participants from across East Africa.

What started as a small gathering last year has become a platform for positioning Zanzibar as more than a tourist destination.

The agenda.

Sessions covered fintech, digital payments, and sustainable technology with speakers from TanzPay, WAGA Motion, the Tanzania Startup Association (TSA), and others.

Gibson Kawago discussed climate entrepreneurship while Kumar Pandya presented payment solutions for the region.

The summit included startup pitches, panel discussions on decentralized technologies, and AI masterclasses for business applications.

Participants also experienced yacht tours and sea adventures. They combined business networking with island experiences.

The sponsors.

LePole Dides and Zanziholics Digital Agency led sponsorship, supported by Oaksvale Ventures, Rock The Yacht, and TSA.

Local businesses including Aura Space, Fumba Town, and Manji Tours provided venues and logistics support.

What’s next.

Organizers plan to expand the 2026 summit based on growing regional interest and investment inquiries generated during the event.

The goal remains building Zanzibar’s reputation as a serious player in Africa’s technology and investment ecosystem.

3. Who Controls Tanzania’s Economy?

Banking giants.

When you need a loan to start a business or buy a house, eight banks dominate the lending market.

Why?

CRDB holds Sh16.6 trillion in assets, followed by NMB Bank at Sh13.7 trillion and NBC at Sh4.3 trillion.

Exim, Stanbic, People’s Bank of Zanzibar (PBZ), Azania Bank, and Standard Chartered each manage between Sh1.9 trillion and Sh3.1 trillion.

Larger banks typically offer more loan products and competitive interest rates because they have more customer deposits to work with.

Communication networks.

Three telecom companies serve most Tanzanians who own mobile phones.

Vodacom has 29 million subscribers, Yas serves 26 million customers, and Airtel connects 21 million people.

Smaller operators like Halotel and TTCL serve the remaining market.

Monthly subscription fees from millions of customers generate steady revenue that these companies use to expand network coverage and improve services.

Payment systems.

Mobile money has become how most Tanzanians handle financial transactions.

M-Pesa processes payments for 27 million active monthly users. Mixx by Yas serves 20 million people, while Airtel Money handles transactions for 15 million users.

Each money transfer generates small fees that add up across millions of daily transactions.

This creates substantial revenue streams for these operators.

Digital platforms.

Banking and payment apps dominate download charts among locally developed applications.

M-Pesa Tanzania, NMB Bank, and CRDB Bank apps each have over 1 million downloads. AzamTV also reaches this milestone in the entertainment category.

High download numbers indicate which services Tanzanians find useful enough to install and keep on their phones.

Business payments.

Mobile money companies handle digital transactions for 89% of participating merchants.

Traditional banks serve 1% of these businesses, while independent payment processors manage 10%.

Sports revenue.

Tanzania’s two largest football clubs generate similar revenue through different approaches.

Simba SC earns Sh835.8 million annually, while Young Africans SC brings in Sh825.1 million.

Young Africans draws larger crowds with 141,911 spectators per season compared to Simba’s 112,717 attendees.

Both clubs monetize fan support through ticket sales, merchandise, and sponsorship agreements.

Business distribution.

Most registered businesses in Tanzania focus on trade rather than manufacturing.

Wholesale and retail trade represents 55% of all businesses, followed by hospitality at 9.3% and manufacturing at 8%. Other service sectors account for 7.5%.

Trading businesses typically require less startup capital and technical expertise than manufacturing operations.

Foreign investment.

International investors focus on sectors with established export potential.

Mining and quarrying attracted $532.5 million in foreign investment during 2023. Manufacturing received $361 million, while finance and insurance drew $267.6 million.

Technology startups.

A small number of tech companies have raised significant funding from international investors.

NALA leads with Sh132 billion in disclosed funding, followed by Ramani at Sh87 billion, EA Fruits at Sh10.7 billion and Credable at Sh6.6 billion. Dawa Mkononi has raised over Sh5.2 billion.

Other funded startups include NovFeed, Laina, Settlo, Selcom, Sarafu, TemboPlus, SafiriApp, Silabu, KopaGas, and Swahilies.

ADDITIONAL HEADLINES

BoT Cuts Mobile Money Transfer Fees

The Bank of Tanzania introduced lower fee caps for wallet-to-bank and bank-to-wallet transfers starting July 1st.

Transfers above TZS 500,000 now cap at TZS 5,000, down from previous rates.

Mobile money operator Selcom Pesa responded by launching transaction bundles, including 150 transfers for TZS 10,500 monthly and 35 transfers for TZS 2,500 weekly.

Otapp Records 4,000 App Downloads in Three Months

The e-ticketing platform reached the milestone from April to June. It connects users to bus tickets, movie bookings, and event reservations across Tanzania.

The company serves as a unified booking hub for flights, buses, entertainment, and cargo services through partnerships with over 200 providers.

Otapp also offers API integration and B2B portal access for travel agencies and businesses.

Ramani Officially Launches

The supply chain financing platform works with Coca-Cola Nyanza, Dangote, Bakhresa Group, and other major brands to provide credit to micro-distribution centers.

Distributors receive goods through WhatsApp integration while brands maintain cash flow without lending to partners.

Ramani has provided over $265 million in non-collateral credit across its network.

Dawa Mkononi Is Hiring

The healthcare supply chain platform has posted openings for one branch manager with pharmaceutical wholesale experience and two sales officers with similar backgrounds.

The company serves 2,200+ active customers across 1,000+ pharmacies, providing $4+ million in credit financing and reaching 500,000+ patients through its medicine distribution network.

Ghala Becomes Official WhatsApp Provider

Merchants formerly needed step-by-step video assistance to navigate Meta Business Manager, create developer accounts, and set up apps using personal Facebook accounts before accessing WhatsApp selling tools.

Ghala’s upcoming embedded signup flow will let businesses join using their current WhatsApp numbers without technical setup.

Tanzania Mandates Microfinance Institutions Join TAMFI or TAMIU

The Bank of Tanzania (BoT) has signed a self-regulatory framework requiring all 2,600 tier-two microfinance institutions to join either the Tanzania Association of Microfinance Institutions (TAMFI) or the Tanzania Microfinance Union (TAMIU) within six months.

Institutions failing to register will lose their licenses, with the associations now responsible for monitoring compliance, enforcing standards, and handling consumer complaints in the rapidly expanding sector.

Black Swan Takes Second Place in Wazo Challenge Tanzania

The credit scoring platform placed first runner-up in Absa Bank’s three-month competition where ten startups pitched banking solutions.

Black Swan’s AI system speeds up loan approvals for individuals and informal businesses across Sub-Saharan Africa.

Ghala and GrupBuy took first and third place in the challenge organized with Hindsight Ventures.