We’re back with the week that was.

In this edition, we explore:

The digital television market reaching 2 million Tanzanian homes

Why mobile money agents are becoming the new face of banking

What’s driving university graduates to build startups rather than seek traditional careers

Plus five more tech ecosystem updates.

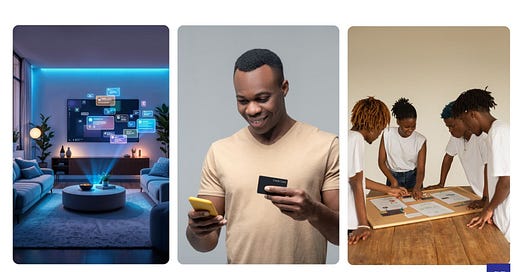

1. Who Watches What in Tanzania?

First, some numbers.

Over 2 million Tanzanian households now access digital television.

1.52 million use the small dishes mounted on rooftops (satellite TV) and 530,000 use the smaller indoor or outdoor antennas (digital terrestrial TV).

This split reveals how geography and income shape entertainment access across the country.

The regional picture.

Dar es Salaam dominates with 678K subscriptions, or one-third of the national total.

This means a single city holds more subscribers than the next three regions (Mwanza, Mbeya, and Arusha) combined.

In some rural regions, less than 2% of households have access to paid television services.

Fact.

Azam Media commands 62.7% of Tanzania’s Pay-TV market with 1.29 million subscribers.

StarTimes follows with 21.6% of the market, while MultiChoice’s DStv holds 11.4%.

Continental, a smaller player, maintains 3.2% market share with 66,697 subscriptions.

What’s ahead?

Subscription growth has slowed to just 2.7% quarterly, indicating the market may be approaching saturation in urban areas.

Meanwhile, unexpected bright spots are emerging in regions like Shinyanga, where traditional cable TV services (with wires connecting to homes) are growing faster than the national average.

The growing popularity of watching shows and movies over the internet (i.e., via Netflix) threatens traditional TV platforms in areas with reliable connectivity.

The opportunity.

2.05 million households can currently pay for media content.

Pay-TV providers can shift focus from expensive customer acquisition to retention (and upselling) strategies that maximize revenue from existing subscribers.

New players, on the other hand, can develop low-cost streaming alternatives to reach the millions unable to afford the upfront costs of satellite dishes or digital antennas.

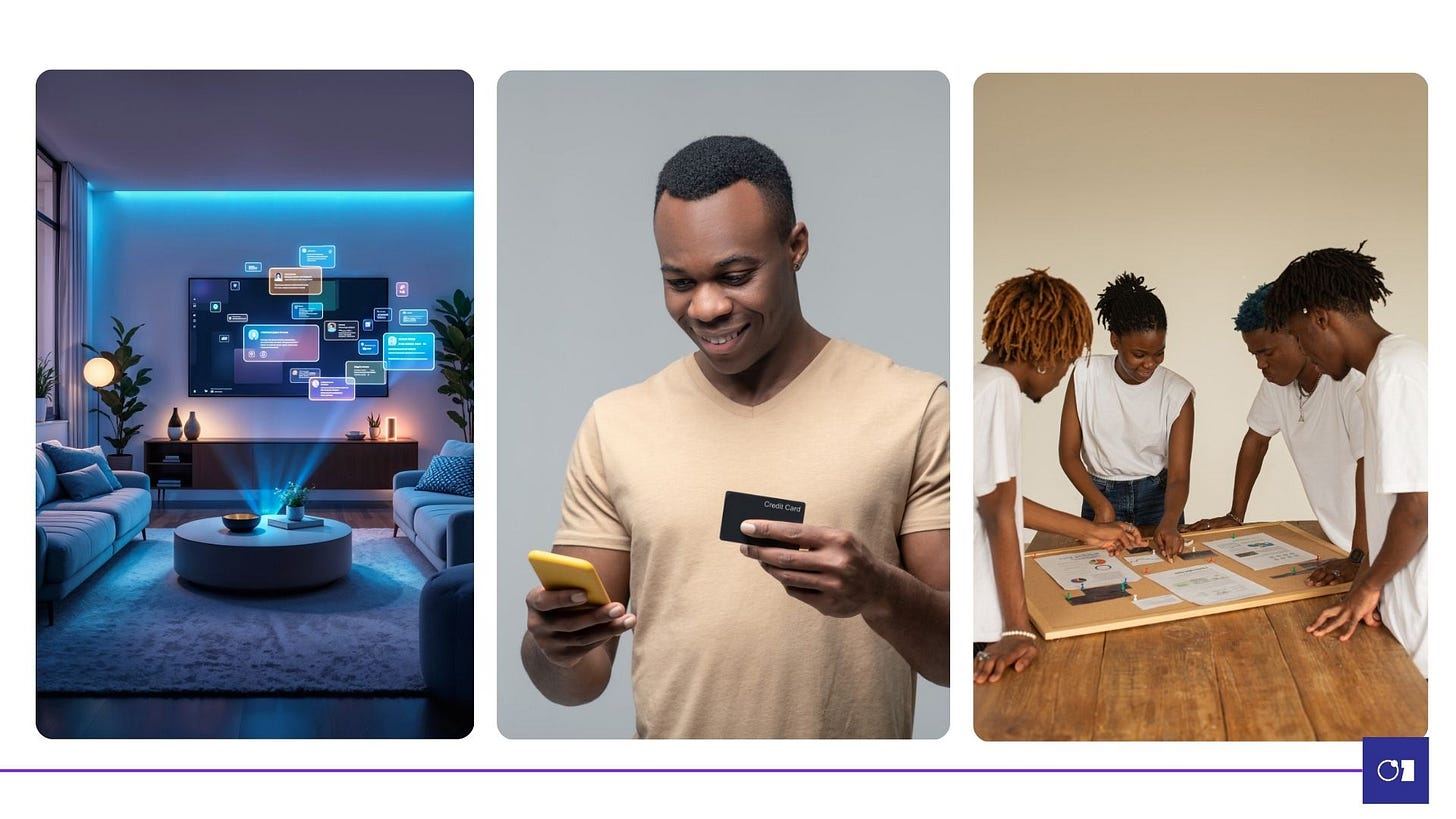

2. Agents Bring Financial Services to Every Corner

First, some context.

In Tanzania today, mobile money agents are within walking distance from most homes.

This network of small shops, kiosks, and dedicated service points expanded to 1.48 million in 2024 – a 19% increase that added nearly a quarter-million new agents nationwide.

These neighborhood financial operators now form the most extensive financial infrastructure in Tanzania’s history.

The economic engine.

In 2024, these agents facilitated Sh43.8 trillion in cash deposits (up 20.6%) and Sh32 trillion in withdrawals (up 14.6%).

More impressively, agents themselves moved Sh9 trillion between their accounts and banks – highlighting their critical role as bridges between cash and digital economies.

Fact.

Mobile money agents now outnumber all bank branches, ATMs, and post offices combined by a factor of more than 300-to-1, making them Tanzania’s most accessible financial touch points.

The opportunity.

While agents primarily handle cash-in and cash-out (CICO) services today, their massive network represents an untapped platform for financial innovation.

This market is primed for entrepreneurs to develop solutions like:

Float management systems that help agents predict and maintain optimal cash levels

Cross-network platforms that let agents serve customers from any mobile money provider through a single interface, or

Specialized credit products designed specifically for agents’ capital needs.

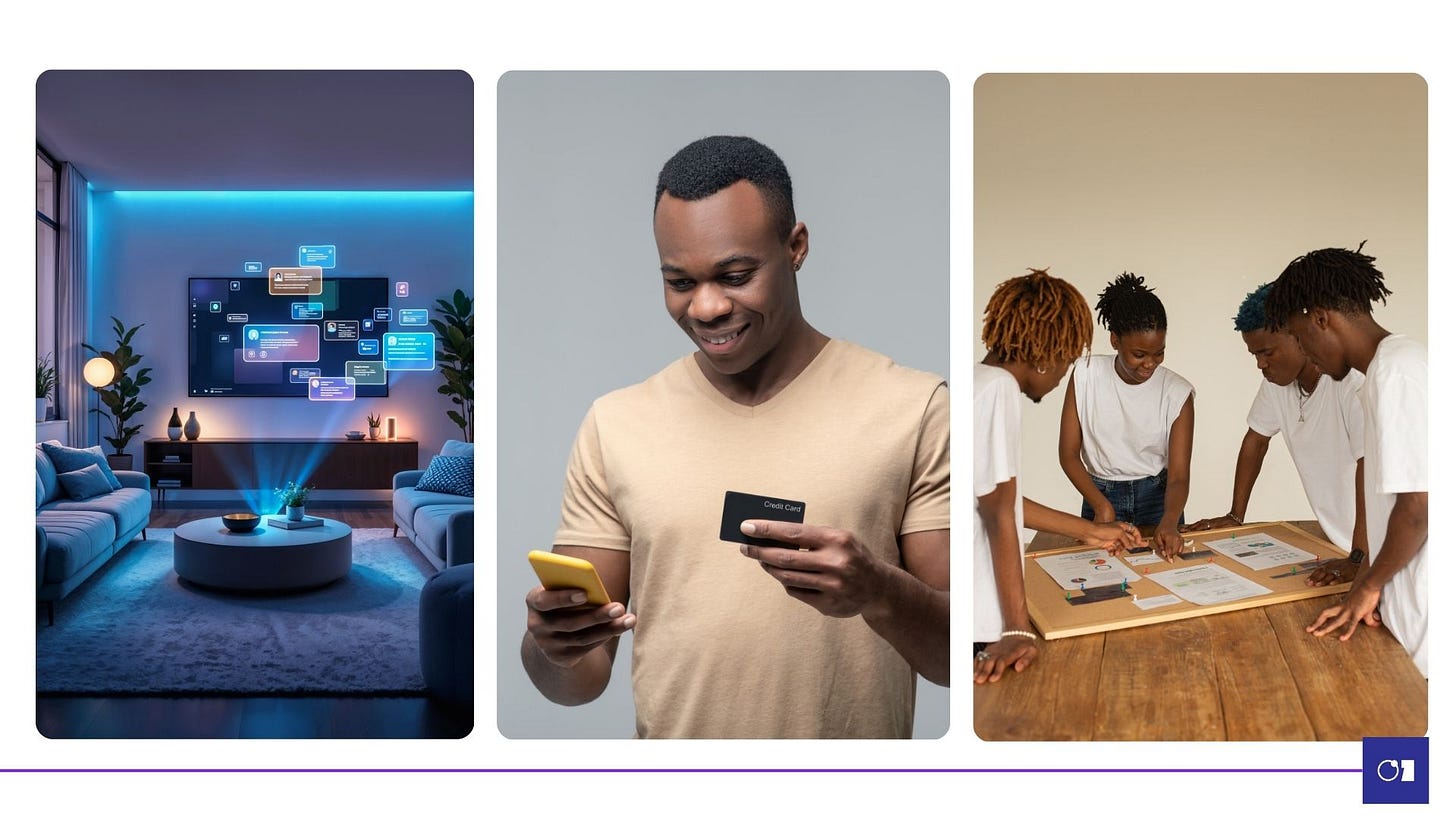

3. Young Tanzanians Are Choosing Startup Life

The education surprise.

In a country where university education remains a privilege, Tanzania’s startup founders are overwhelmingly well-educated.

According to TSA, about 74% hold university degrees, and another 18% have college diplomas.

Together, these formally educated entrepreneurs account for 92% of all founders.

The university connection.

UDSM alone has produced 19% of all Tanzanian startup founders – more than any other institution.

Other significant contributors include Sokoine University of Agriculture (7.6%), Mzumbe University and the Institute of Finance Management (IFM) contribute 6.3% each.

Fact.

Despite high education levels, 65% of Tanzanian founders are first-time entrepreneurs, indicating that startup creation represents their initial venture rather than being led by serial entrepreneurs.

The age factor.

Youth dominates Tanzania’s startup ecosystem, with 75.2% of founders aged between 18 and 34.

The largest founder age bracket is 30-34 years (31.2%), followed by 25-29 (24.8%), and 18-24 (19.2%).

These demographics reveal that entrepreneurship has become a first-choice career path for educated young Tanzanians rather than simply a fallback option.

The opportunities:

Create a “First Step Fund” for recent university students turning down job offers to pursue startup ideas.

Build extended apprenticeship programs where established companies “host” young founders for 6-12 months while they develop their ventures.

Develop specialized legal toolkits for first-time founders to protect IP without expensive legal counsel.

ADDITIONAL HEADLINES

Internet Users Increase

Nearly three-quarters of Tanzanians now access the internet, with 49.3 million subscriptions as of March 2025.

The vast majority connect through mobile devices, with fiber internet accounting for just 0.2% of connections despite offering speeds more than double those of mobile networks.

Bank Backs Startups

In 2024, NMB deployed $36.8 million to Tanzanian startups and innovative SMEs.

Their investment, representing 85% of all domestic startup lending, creates a crucial alternative to foreign venture capital for early-stage companies.

New Digital Divide Revealed

While 5G now reaches 23% of Tanzania’s population through 928 base stations, coverage remains heavily concentrated in urban centers, with Dar es Salaam hosting 76% of all infrastructure.

This urban-rural technology gap threatens to widen economic disparities if not addressed through strategic rural expansion.

Fintech Takes 78% of VC Funding

Of the $53 million raised by Tanzanian startups in 2024, $41.4 million went to fintech ventures, followed by agritech at $9.2 million.

This concentration leaves other promising sectors like healthtech, edtech, and logistics competing for the remaining 4.5% of available capital, creating notable funding imbalances across the ecosystem.

Digital Merchants Reach 1.3 Million

The number of businesses accepting e-payments more than doubled in 2024, leaping from 657K to 1.3Mn.

While Dar leads with 29.7% of all digital merchants, regions like Mbeya (7.1%) and Mwanza (8.9%) are rapidly catching up, showing digital commerce spreading beyond the commercial capital.