Introduction

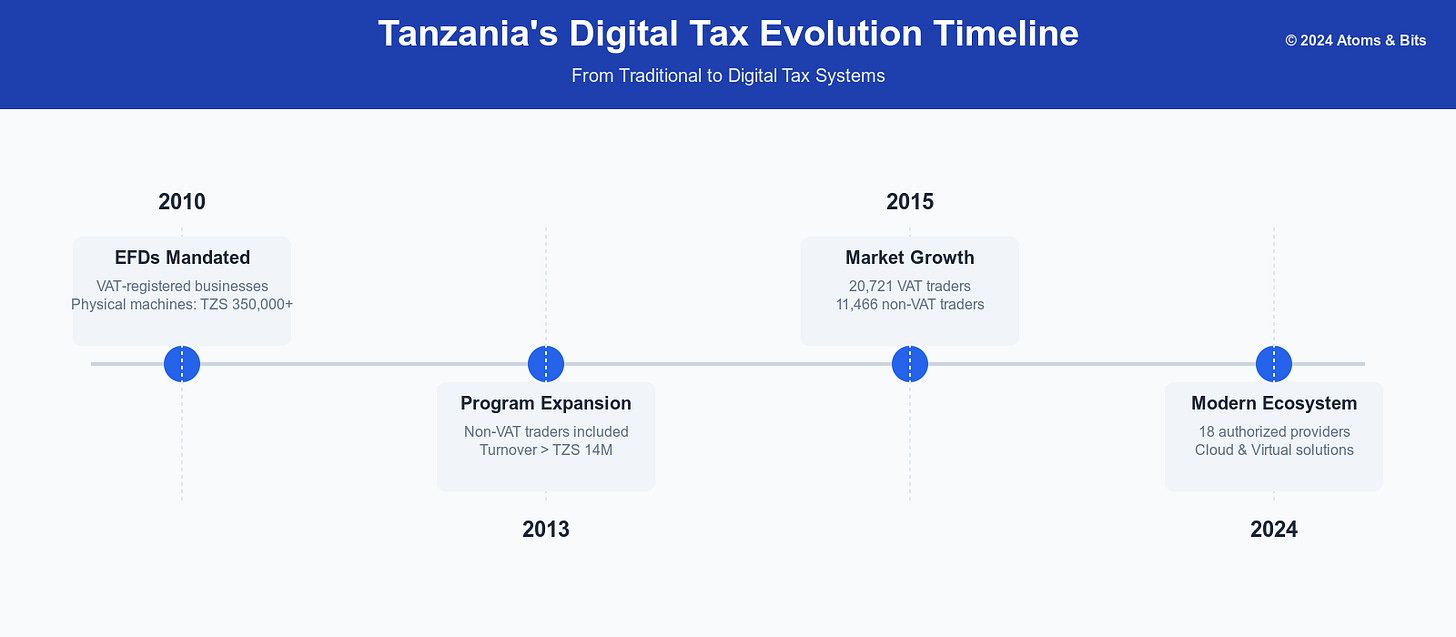

Tanzania's digital tax compliance journey began in 2010, when TRA first mandated Electronic Fiscal Devices (EFDs).

The initial rollout targeted VAT-registered businesses, requiring them to purchase physical machines costing upwards of TZS 350,000. By 2013, the program expanded to include non-VAT registered traders with annual turnover above TZS 14 million.

This transformed tax collection efficiency. Revenue increased from TZS 9.9 trillion in financial year (FY) 2014/15 to over double that amount (TZS 26.7 trillion) in FY 2023/24.

What's often overlooked is how this shift fundamentally changed Tanzania's entrepreneurial scene by widening the tax base and reducing evasion.

Before EFDs, tax compliance relied heavily on paper receipts and manual audits. The introduction of digital systems marked Tanzania's first large-scale push toward business automation.

Businesses must report income, generate receipts, file returns, and remit payments on time. Modern tools make compliance a real-time online responsibility instead of an accounting burden.

Today's Tax Technology Industry

As of January 2023, TRA had authorized 18 fiscal solution providers—a market that has evolved from simple receipt-printing machines to sophisticated cloud platforms. We have broken down this fintech sub-sector into three distinct segments.

Traditional Hardware Providers

Power Computers leads traditional EFD deployment with physical machines imported from China. Their systems emphasize reliability through dedicated hardware but require significant upfront investment.

Cloud-Native Solutions

Simplify VFD exemplifies the new generation of app/browser-based platforms. With setup costs of TZS 142,780 and annual fees of TZS 69,620, they've made invoicing more accessible for growing enterprises.

Hybrid Offerings

Companies like Radix, Zalongwa, and Web Corporation operate in both worlds. They offer both physical devices and virtual solutions, mostly for fuel stations and large enterprises. This flexibility comes at a premium, with setup fees typically exceeding TZS 500,000.

Types of TRA-approved Fiscal Devices

TRA recognizes five distinct categories of fiscal solutions, each designed for specific business needs and operating environments.

Electronic Tax Registers (ETRs) serve retail businesses issuing handwritten receipts. They provide basic sales tracking and tax calculations. Electronic Fiscal Printers (EFPs) connect to existing computerized retail systems, storing all transactions in secure memory. These suit businesses already using point-of-sale (POS) software.

Electronic Signature Devices (ESD) authenticate computer-generated receipts and invoices with unique digital stamps. This option works well if you prefer using your existing accounting systems.

Electronic Fiscal Pump Printers (EFPP) integrate directly with fuel dispensing systems at petrol stations, ensuring every sale is properly recorded and reported.

The newest category, Virtual Fiscal Devices (VFDs), eliminates physical hardware requirements entirely. It includes pure software solutions that run in web browsers and mobile apps.

Each device type must meet TRA's core requirements: tamper-proof revenue memory, automatic daily Z-reports, direct data transmission to TRA, and unique receipt identification. Physical devices must also provide 48-hour power backup and maintain five years of transaction history.

Getting Started with Virtual Compliance

Before implementing any VFD solution, businesses must complete several crucial steps. Below I have used Simplify’s onboarding process as an example.

Why? Installation costs USD 52.34, and the first annual subscription costs USD 25.52. At a total of TZS 212,400, it's cheaper than what other companies charge new customers.

Documentation Requirements

Valid TIN certificate

National ID verification

Formal request letter to TRA using their template

Regulatory Approval Process

Initial TRA application review (2-3 days)

Payment of registration fees

Customer visits local tax office for final verification

System activation approval

Technical Setup

Internet connectivity assessment

User access configuration

Login credentials sent via email

Staff training scheduling

Test transaction validation

You should maintain manual receipt books during the first week of implementation. This parallel system, while seemingly redundant, ensures smooth transition and maintains compliance during initial staff training and system optimization.

I believe that your preferred fiscal solution must be modern enough to work seamlessly with existing business tools.

Simplify, for instance, enables integration with third-party inventory and accounting software while providing EFD signatures on invoices. Its application programming interface (API) is utilized by reputable companies across various sectors, including transportation, oil and gas, tourism, and healthcare.

That service integration capability reduces double entry and reconciliation time. It’s a crucial factor for companies handling hundreds of daily transactions. For detailed information, email sales@simplify.co.tz or call +255 745 507 103 / 0658 507 103.

Regional Context

Tanzania's approach mirrors trends in developing economies. Kenya's iTax system and Rwanda's Electronic Billing Machines (EBMs) show similar evolution from hardware to cloud solutions. However, each country has unique requirements:

Rwanda mandates centralized billing for all businesses above RWF 20 million (TZS 40.73 million) annual turnover

Kenya allows mobile-first solutions integrated with M-PESA

Tanzania emphasizes real-time data transmission to TRA

Market Performance and Adoption

Data from the Tanzania Revenue Authority reveals interesting adoption patterns.

Of the 25,908 VAT-registered traders, 20,721 (~80%) had acquired EFDs by June 2015. 11,466 non-VAT traders acquired fiscal devices during Phase II implementation, primarily in sectors like spare parts, hardware, pharmacies, and hospitality.

This expansion indicates growing acceptance of digital compliance tools among smaller enterprises

Making the Choice

When evaluating fiscal solutions, businesses should consider:

Infrastructure reliability (especially internet connectivity)

Growth projections and scalability needs

Integration requirements with existing systems

Total cost of ownership, including maintenance

Staff technical capability

If you own or operate an urban enterprise with stable internet, virtual solutions—like Simplify VFD—provide clear advantages in cost and flexibility. Rural operations might still benefit from traditional EFDs' offline reliability.

Conclusion

Tanzania's shift to digital tax filing indicates modernization of our financial infrastructure.

Since mobile money transactions exceed TZS 12.6 trillion monthly (2023) and fintech adoption grows, cloud-based tax solutions become natural extensions of how Tanzanian businesses operate.

The next evolution will likely merge compliance, payments, and business intelligence into unified platforms accessible to enterprises of all sizes.